Hello investors! If you’re new here, add your email below to get every edition of Opening Bell Daily in your inbox, free.

Turns out the stock market doesn’t always follow Nvidia.

As the chip-maker soared 9.3% and closed at yet another record-high Thursday, the Dow tanked on its way to its worst trading session in more than a year.

Hot services and manufacturing data and lower-than-expected jobless claims deflated investors’ hopes for rate cuts from the Fed.

That said, the big news happened after hours.

Crypto, politics, and billions of inflows

Wall Street’s new favorite crypto bet has nearly arrived.

Late Thursday, Securities and Exchange Commission approved key regulatory filings for spot ether ETFs, opening the door for mainstream investors to access the world’s second-largest cryptocurrency.

Just before the decision deadline, the Gary Gensler-led regulator gave the greenlight for the following companies to list products on major stock exchanges:

BlackRock

Fidelity

Grayscale

Bitwise

Ark/21 Shares

VanEck

Invesco

Franklin Templeton

Hashdex

While the SEC has not cleared these companies to begin trading, this marks the steepest hurdle before hitting markets.

The next step will be approving issuers’ S-1 filings.

The price of ether is up roughly 64% this year, and it’s climbed 22% over the last five days.

Source: Google

The intrigue here, however, is the SEC’s sudden about-face. No one expected Gensler — who has a reputation as anti-crypto — to allow ether anywhere close to Main or Wall Street.

Speculation has erupted over the timing and politics of the move.

“A week ago, I would've said you were a little crazy to think that these ETFs were going to get SEC approval," said James Seyffart, an ETF analyst with Bloomberg Intelligence, in an interview with CoinDesk.

Pro-crypto US lawmakers wrote a letter to the SEC Wednesday vying for approval of the ETFs, and the same day the House passed a bill that aims to provide clarity for what tokens fall under the SEC’s purview.

And weeks ago, former President Donald Trump said he, too, is pro-crypto.

Last I checked, a financial regulator is not supposed to succumb to politicking. Yet it appears Gensler has done just that.

“Politics is powerful, and especially in an election year,” Eric Balchunas, another Bloomberg ETF analyst, told Fortune.

“What we've heard inside is that this was politically driven. The Democrats do not want to see Donald Trump and the Republicans win on this issue, and lose votes from single-issue voters.”

Tomfoolery aside, there’s big money at stake. The SEC’s move comes just a few months after it approved 11 spot bitcoin ETFs from many of the same companies.

Since January, institutional players have poured billions of dollars into those bitcoin funds, and the crypto has climbed more than 50% year-to-date.

If even a fraction of that amount goes into ether, that would make the ETFs wildly successful in the context of typical debuts for Wall Street products.

“What the ETF wrapper has done for bitcoin is now possible for ether,” said Nathan McCauley, the CEO of crypto bank Anchorage Digital.

“By providing a regulated and accessible pathway for direct ethereum exposure, a spot ETF marks a major unlock for billions in institutional dry powder.”

Do you think the SEC’s U-turn was politically motivated? Hit reply to this email or let me know on X @philrosenn.

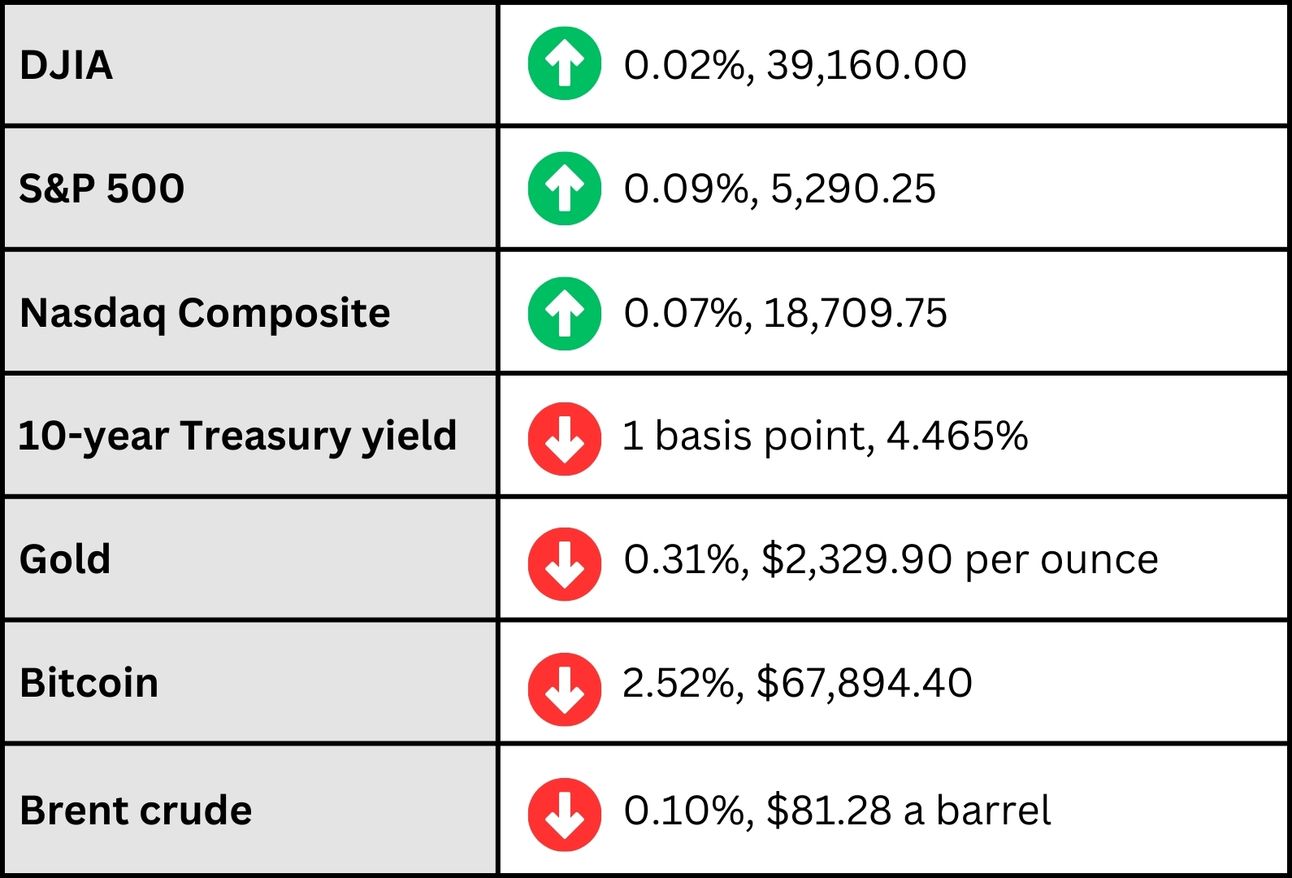

*At a glance:

*Data as of Thursday 9 p.m. ET

Elsewhere:

US business activity is running hot. S&P Global’s flash May gauge climbed to its highest mark since April 2022, beating all Wall Street forecasts and underscoring the Fed’s case to keep rates higher for longer. (Bloomberg)

Nvidia confirms the AI boom is just starting. Revenue jumped 262% compared to a year ago, and Jensen Huang said “the next industrial revolution has begun” with AI. But it’s not just Nvidia — the same forecasts and comments are showing up across companies and industries. (TKer)

Millionaires abound. Soaring stocks have boosted the number of seven-figure retirement accounts, according to Fidelity. In the first quarter, the brokerage saw a record 485,000 401(k) accounts with $1 million or more. (MarketWatch)

Rapid-fire:

Morgan Stanley’s chairman is stepping down at the end of the year (Bloomberg)

Live Nation stock fell 7.8% after the Justice Department filed an antitrust lawsuit against the company (Barron’s)

Elon Musk says Tesla can compete with China without tariffs (WSJ)

Citi, HSBC, Barclays demand employees work five days a week in office (Bloomberg)

Peloton secured a $1 billion loan to shore up its struggling finances (FT)

Last thing:

Interested in advertising in Opening Bell Daily? Email [email protected]