Hello investors! If you’re new here, add your email below to get every edition of Opening Bell Daily in your inbox, free.

Good morning investors,

I’ve always been impressed by Elon Musk’s ability to juggle multiple multibillion-dollar companies.

That said, some say the billionaire looks close to dropping the ball with Tesla.

Today we’re covering what to know before the car producer reports earnings this afternoon — and why short sellers love betting against it.

After, we’ll get into Monday’s stock rebound, JPMorgan’s bleak forecast, and soaring borrowing costs for students.

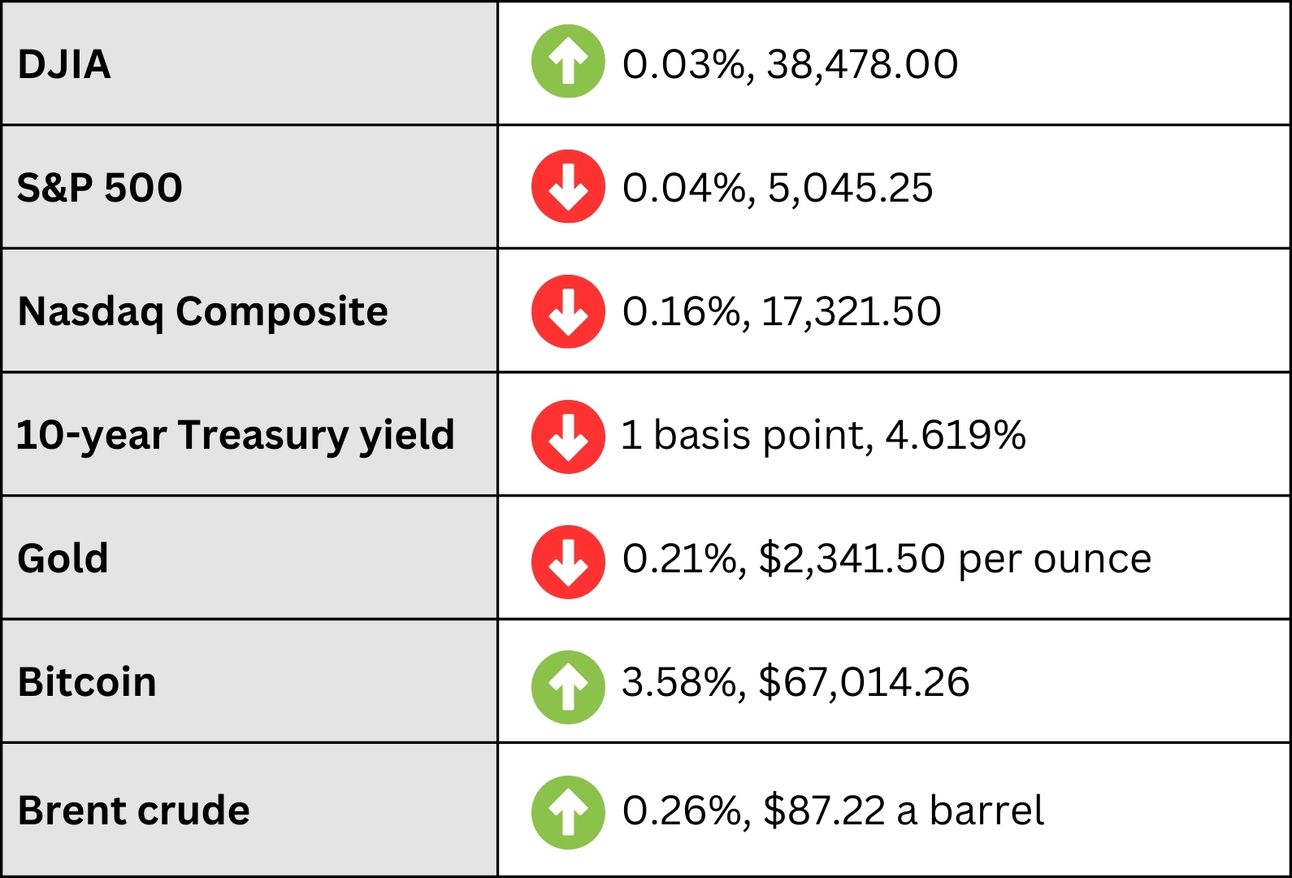

*At a glance:

*Market data as of 10 p.m. ET

It’s expensive to bet against Elon Musk

Made with AI by Opening Bell Daily

On Monday, Tesla stock dropped for a seventh consecutive trading day to close at $142 a pop, the lowest in 15 months.

Shares have tumbled 43% this year, and analysts expect earnings to show a 5% revenue decline compared to the same period in 2023.

To that point, Elon Musk and his company have faced a grab bag of recent headwinds:

Price cuts for vehicles and driving-assistance software

Layoffs for 10% of staff

A recall of nearly 4,000 Cybertrucks

Lower-than-expected car deliveries

Controversy over Musk’s $56 billion pay package

Here’s what Bank of America strategists had to say:

“We retain some level of skepticism on Tesla's growth prospects, but also see opportunities as the company will unveil future growth drivers (Robotaxi and Model 2) in the coming months, which alone may be enough to support the stock.”

Source: Bank of America, Bloomberg

The above storylines have been a boon to those betting against Tesla the last few months.

The car company currently sits behind Nvidia, Microsoft, and Apple as the fourth most popular stock to bet against in US markets.

Short interest in Tesla now hovers at $16.62 billion, according to data from S3 Partners.

That’s climbed roughly 28% since January — a nod to the diminishing expectations for Tesla and, by extension, Musk himself.

Given the stock’s weakness in 2024, short sellers have netted billions in profits over the last several months.

Long-term investors, though, think in decades, not quarters.

Since debuting in public markets more than a decade ago, betting against Tesla has actually resulted in massive losses.

“[Tesla] has been a boom or bust trade for the short side for years,” Ihor Dusaniwsky, the managing director at S3 Partners, told me.

“But mostly a bust, with short sellers down $52.5 billion in mark-to-market losses since its IPO in 2010.”

Dusaniwsky said some money managers short Tesla as a way to hedge against weakness in the tech sector at large, or to move against meme stock trends.

In any case, even as betting against Tesla has surged in popularity, so has enthusiasm in the other direction.

Vanda Research estimates retail investors have deployed roughly $5.9 billion into Tesla stock this year, per WSJ, more than any other big tech name.

And as for the mercurial Musk — who divides his time between Tesla, SpaceX and other companies — no one has more experience (or fun) proving naysayers wrong.

So yes, the bearish media headlines and near-term market reaction will likely follow today’s report. Depending on your algorithm, you’ll come across negative responses across Reddit and X, too.

Indeed, short sellers will celebrate if Tesla misses expectations.

To me, Wall Street’s 12-month price targets provide a more even-handed outlook as to who may get the last laugh between Musk and his doubters.

Among the dozens of analysts who cover Tesla, the average price target is currently $190 — about 30% higher than Monday’s closing price, per FactSet.

Tesla’s earnings are due today after 4 p.m. ET.

Elsewhere:

Big Tech names led a Monday stock rally. Markets climbed into the green after last week’s sell-off. For now, investors are dialed in on earnings rather than delayed policy easing. (WSJ)

JPMorgan’s top strategist sees more pain for stocks. Marko Kolanovic told clients Monday the “correction likely has further to go.” He said hot inflation, Fed repricing, and a too-optimistic profit outlook bode poorly for equities. (Client research)

Borrowing costs for student loans are hovering at levels last seen in 2008. Soaring Treasury yields and a murky Fed outlook bode poorly for a slice of the population that’s among the least able to afford debt. (Bloomberg)

Rapid-fire headlines:

PepsiCo and Visa report earnings today

Verizon stock plunged after missing revenue forecasts (WSJ)

Donald Trump just nabbed an additional $1.25 billion in Trump Media stock (CNBC)

BlackRock’s Rick Rieder expects two rate cuts in 2024 (Bloomberg)

Two SEC lawyers have resigned after power abuses in crypto case (Bloomberg)

China’s booming bubble tea market has minted multiple billionaires (Business Insider)

Last thing:

Interested in advertising in Opening Bell Daily? Email [email protected]